The currency market is in severe turmoil right now. The Euro’s future still looks uncertain and the Dollar’s not out of the woods yet either. The Yen and the Swiss Franc are up and overall confidence is down. It’s quite a storm out there, and the winds seem to keep changing direction daily. Some times forex trading tips can help.

Still, if you’ve got the instincts and the experience and know which way to tack your sails the opportunities exist to make yourself a fortune trading currencies on the Forex market.

We want to share the best forex trading tips we can that could give you a edge in the market.

What is Forex?

Forex is an abbreviation for foreign exchange. Basically those in the forex market are involved in buying and selling currencies. No currency truly has a set value, its value is forever rising and falling.

Market forces are the ocean on which the currencies are forever bobbing up and down. You buy a lot of a certain currency today, tomorrow it could be worth less, so you make a loss.

Alternatively it could be worth a good deal more tomorrow, so you sell it for a nice tidy profit.

Forex Dos:

Forex trading is something which can make you an awful lot of money if you know what you’re doing. And it can cost you a lot if you don’t.

It’s a skill you need to learn and practice. To help you, you should focus on these three main areas.

Learn The System

I’m a successful forex trader, but I haven’t stopped learning. I’m still reading different tactics and strategy guides on a regular basis, it’s always good to have fresh perspective and mix things up a little.

The way I see it is, if I want to make money, I need to keep investing in my skill sets. And that’s the real secret to forex success right there – learning.

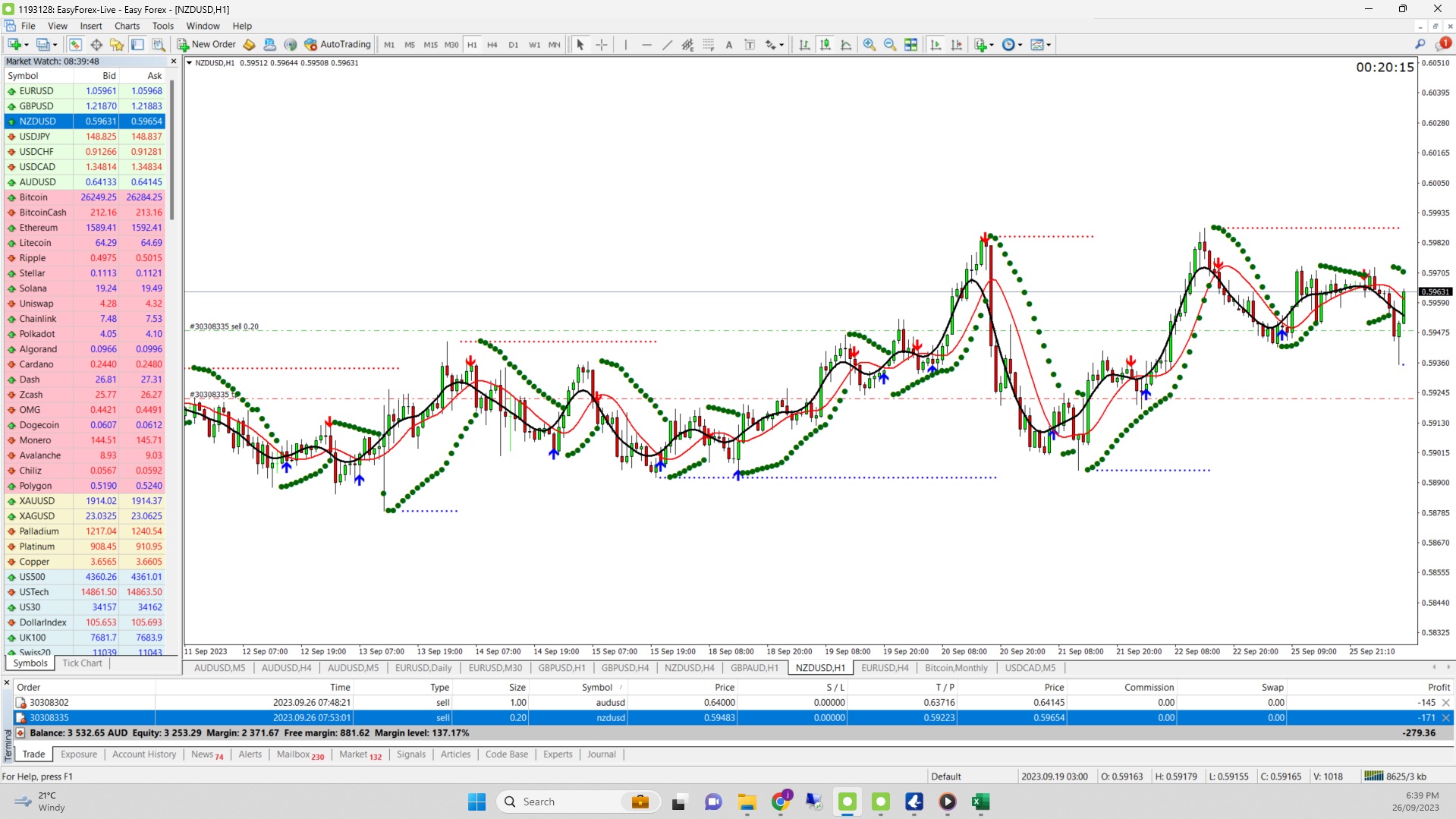

You need to learn, first of all, how forex works, you need to learn how to read all those confusing graphs and charts and get to the stage where, you need only glance at them to understand their meaning – to get the point where it becomes instinctive. So that you’re 100% comfortable whilst trading, though never smug.

It’s important that you learn to use your software correctly. Every different forex trading software has a somewhat different layout so make sure, before you get in deep, that you know and understand your software and the telemetry it’s giving you inside and out.

Learn your Currencies

As I said I’ve read so many different forex guides, probably more than most, some of the advice was great some of it not so great.

One thing you don’t see, however, is someone talking about the currencies themselves, at least not in any real detail.

One thing you need to understand about currencies is that not all currencies are created equal, and you really ought to understand more about what’s happening behind the currencies.

The Euro is a perfect example, the Euro is unpredictable because it isn’t centrally controlled. Most currencies are national currencies but the Euro is shared by everyone from über-conservative Germans to the wildly flamboyant Greeks and Italians. So really nobody knows quite what’s going to happen to it.

You shouldn’t just be watching your graphics you need to listen a lot to the news and get the big picture also.

Learn the fundamentals as well

For example if you turn on the news right now one story might be the debate about whether or not to devalue the Swiss Franc.

Demand for a safe currency has driven its value up. When this happens governments sometimes intervene.

Keeping currencies low makes it easier for countries to export. The Chinese keep their Yuan low for this exact reason.

The US Dollar, meanwhile, is used as a reserve currency by many countries including China, who have a large interest in keeping the dollar stable.

It is also the currency of OPEC and many of the countries in the Middle East have their currencies pegged to the dollar.

By learning the mechanics behind currencies you are better able to understand the currency markets, and how different currencies are interconnected with one another.

This gives you the type of insight you won’t get by just looking at the graphs and will give you an indication not just how a given currency will perform but also the likelihood that governments will intervene to artificially adjust the currency’s value.

Practice first

Make sure you start with a practice account first, it’s just common sense.

Too many people start off in forex to try dive right in. They end up wasting a lot of money as they flounder to grasp the basics, become overwhelmed, overleveraged and eventually throw in the towel – big mistake.

There really is a lot of money to be made in this game but – to reiterate – you need to do your homework first and practice.

Practice accounts allow you to develop these skills and instincts without actually costing you anything so using them really is a no-brainer.

That it for the forex trading tips do, lets take a look at the don’t.

Forex Don’ts:

Don’t loose control

If you don’t control your greed, your greed will control you. The same goes for fear.

These are both two irrational states of mind, and in forex, they are your enemy.

Greed makes you take stupid risks, often with money you can’t afford to loose.

It makes you over-extend yourself until you’re leveraged up to your tonsils.

That’s the sort of thing that the banks on Wall Street done – and we all know what happened to them.

Fear is the opposite, it’s what makes you doubt yourself and chicken out when all indicators say you’re onto a winner.

To make it in this game you need to rely on a combination of cold, hard facts and figures and razor sharp instincts. If you let your emotions take over then you risk getting swept away by the mob.

Don’t forget the plan

This one should be the corner stone of the forex trading tips. As they saying goes “fail to plan, plan to fail”.

This is more difficult than it seems, however. If everyone’s buying but you’re selling you might find yourself stopping and wondering if you really are doing the right thing – doubt sets in.

Your rational, calculating side will know you’re right, but your fight-or-flee animal instinct will try and take over. The result is a game of cerebral tug-of-war and severely clouded judgement. Not good.

This is the one thing a practice account won’t prepare you for – the jitters.

The solution? Make a plan. Have a plan as to exactly how much you’re going to buy and sell and when to stop.

Set your orders in advance – these are orders that you use to automate transactions. For example you might set an order to keep purchasing a certain currency until its value reaches a certain height.

To be really successful you need to learn to commit to a certain plan in your mind. Not just by setting buy and sell orders.

Because you can always disable an order when you get the jitters, so you need to actually disable the jitters at their source.

Of course sometimes you might find yourself saying, “Oh if I’d just held out a little longer I could have made more”. But the flip-side is you could have also lost more.

Instead you stuck to your guns and made a handsome profit for the day. Keep it at this and as you begin to get better and better you can up the ante and make even more – just be sure you still have a plan.

Don’t get caught by scams

The key to forex is understanding the system, but understand too there is no one true system. If there was we’d all be rich, right?

So always beware of people who have the answers and want to sell them to you. If you had the secret to untold wealth you wouldn’t want to share it with anyone, and if it really was making you so much money why bother to sell it? It simply isn’t logical.

Only last week the currency and stock markets were going absolutely bananas. Every president and prime minister from America, Europe and the Far East were all biting their nails in terror because none of them knew what was coming next.

And yet “some guy on the internet” will tell you he knows exactly what the state of the market will be next week? I don’t think so.

So beware of the gurus and beware of the wonder software salesmen too.

Seriously, if there really was a silver-bullet software application. That can guarantee you can never loose money on the foreign exchange market. Then surely the European Central Bank would be using it right now, wouldn’t it now.

There you are the best forex trading tips that we know. We hope it gives you the edge you need.